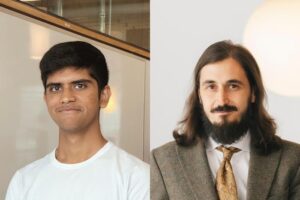

Julian Hill was taken aback by his specialist’s reaction when he asked to be tested for a potentially life-threatening genetic condition.

The federal Labor MP’s daughter had been diagnosed with a genetic mutation that could increase the risk of blood clots and he wanted to see if he too carried it.

His doctor’s advice?

“He said, ‘Don’t get tested for this,'” Mr. Hill said.

“And I said, ‘well, why not?’. He said, ‘well, mostly, because it will hurt your insurance. So I would suggest not doing it.’

“The risk was that it could hurt my future insurance prospects — and it opened my eyes in a small, personal way to some of the dangers of genetic testing.”

Mr Hill’s daughter Elanor Devitt was healthy, fit and just 20 when a potentially fatal blood clot formed in her leg while she was traveling overseas.

“I started having pain in my legs … but it would become so unbearable that I couldn’t walk. I held onto a wall to walk,” she said.

Ms Devitt was hospitalized in Sri Lanka for treatment and when she returned to Australia it was confirmed that she had factor V Leiden, a genetic condition that can increase the risk of blood clots.

This risk was further increased by long-haul flying and a birth control pill she was given, contributing to blood clotting.

“I have this condition for life. I didn’t ask to have it. It’s something I have to live with now,” she said.

‘Time to bite the bullet’

Hill is now calling on his colleague Stephen Jones, the financial services minister, to urgently implement a total ban on the use of genetic testing in life insurance.

The government is considering its response to the consultation on the issue, which ended in January and received more than 1,000 submissions.

A Senate inquiry report into the diagnosis and treatment of cancer, published last week, also recommended that the government urgently legislate a “complete ban on genetic discrimination in life insurance”.

“Successive governments have rightly promoted genetic health and genetic testing and invested in medical research, and this can empower Australians to understand their genetic risks,” Mr Hill said.

“But while we are promoting genetic health, on the other hand, the clear exemption that currently exists in Australian law allows life insurers to genetically discriminate against people.

“It’s time to bite the bullet and … legislate to stop discrimination based on genetic inheritance and genetic testing.”

Dr Jane Tiller from Monash University led a Commonwealth-funded research project on patients’ experiences of genetic discrimination.

He found that consumers were putting off genetic testing because they were worried they would be denied insurance.

“Whenever someone is thinking about whether they want to have a genetic test or want to be part of genetic research, we have to tell them that life insurance implications can be part of signing up for that,” Dr Tiller said.

“We found that the majority of people in all of those stakeholder groups believed that legislation was required on this issue.”

Industry backs ‘near total’ ban

The Financial Services Council (FSC), which previously oversaw the life insurance industry, introduced a self-regulatory moratorium in 2019 to prevent genetic discrimination.

Under the guidelines, genetic testing results cannot be collected by the insurer for policies up to $500,000.

Dr Tiller said a partial moratorium only protects up to certain financial limits and is not legally binding.

“People who were trying to apply for coverage that was above those limits could be discriminated against. The other issue was that it’s not … required by law. It doesn’t change insurers’ fundamental legal right to have this information.”

Dr Tiller wants the Disability Discrimination Act to be amended to make it illegal for life insurers to use genetic test results to discriminate between risk-rated insurance applicants.

The industry is now represented by the Council of Australian Life Insurers, which supports a “near total ban” on the use of genetic test results in underwriting insurance.

CEO Christine Cupitt said life insurers in Australia have “never required and will never require anyone to take a genetic test.

“It has never been the life insurance industry’s intention to prevent people from having genetic tests that give them more information about their overall health,” she said in a statement.

“We support strict regulations on the use of genetic test results in underwriting with limited exemptions approved by the government to ensure fairness for all insured Australians.”

Ms Cupitt said most of the 15 million people with life insurance in Australia get cover without having to disclose genetic test results because they have life insurance through their superannuation, which does not involve an underwriting process.

“People should feel free”

But Dr Tiller said anything short of a total ban could create loopholes for the insurance industry and lead to uncertainty for policyholders.

A full legislative ban would bring Australia in line with Canada, which made the change in 2017.

Julian Hill said the government wants all Australians to take control of their health.

“If you have the opportunity to get tested, people should feel free to do it without thinking ‘it’s going to …’deny me life insurance’ or ‘cost me forever,'” he said.

“I don’t want to regret understanding your heritage and your health and trying to do things to live a longer, happier, healthier life.”

Ms Devitt wants to ensure Australians can get insurance cover regardless of genetic test results.

She now struggles to get travel insurance when she goes overseas and is worried about the life insurance implications.

“If you can’t get life insurance … as a result of something that’s due to a genetic makeup … it can become expensive and really dangerous,” she said.

Loading…

#MPs #daughter #died #common #genetic #disease #tested #doctors #answer #shocked

Image Source : www.abc.net.au